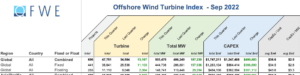

With the addition of 115 new global offshore wind projects during 3Q, Quest Floating Wind Energy (Q FWE) are actively tracking 696 projects (with statuses Possible, Planned, Pre-development and Under development) representing $1.75 trillion in CapEx, a one-half billion quarter over quarter gain. The Quest Offshore Wind Turbine Index (QOWTI), which tracks the Total Addressable Market for global offshore wind*, rises to 47,751 Turbines in September 2022, an increase of 13,167 Turbines since June.

Europe and Asia Pacific are now neck-in-neck in total project count (276) vs. (270) while Europe maintains its dominance in total CapEx and MW density at $636.8 billion and 206.1 gigawatts (GW), respectively. Regionally, Asia Pacific follows with 160.5 GW of future projects denoting a total CapEx of a $506.4 billion, denoting a quarter over quarter gain of $108 billion. South America continues to outpace North America with a CapEx of $438.7 billion adding a whopping $273.3 billion since June. North America remains lively representing a total Capex of $136.9 billion led by the USA Atlantic market.

Fixed-bottom Wind

For fixed-bottom wind, QOWTI’s projected CapEx stands at $1.3 trillion across 441 projects comprising 36,641 turbines. Following an astonishing 157,936 MW of global fixed capacity additions this quarter, South America stands at 170,663 MW, with Europe at 122,094 MW of nameplate capacity followed by Asia Pacific representing 110,749 MW and The Americas denoting 41,232 MW. For fixed-bottom wind, Brazil led the world in project additions with the largest net gain of 7,342 WTG units (turbines) followed by Asia Pacific (2,648) where Taiwan led country distributions at (1,035), followed by Australia (743), Japan (365), Vietnam (366) and South Korea (300).

Floating Wind

For floating wind, Quest Floating Wind Energy’s Q Vision illustrates a Total Addressable Market in CapEx of $484 billion, a sizeable gain of $101.1 billion during 3Q. Europe maintains a 55% share of global floating CapEx ($268 billion) whilst also continuing to lead the world in project additions with over 20.6 GW from 1,403 floating turbines in the quarter denoting CapEx of $66.5 billion. The United Kingdom measured the largest net gain of 615 floating turbine units followed by Ireland (215), Spain (211), Italy (183), Norway (100) and Sweden (79). Europe now totals 6,087 floating turbine units representing a total capacity of 83,974 MW across 149 projects.

*The Total Addressable Market represents the 696 global projects which are either under development, pre-development, planned or possible tracked by Q FWE’s proprietary Q Vision database. Due to the ‘closed’ nature of the Chinese market, China and parts of India are largely excluded from our coverage (these areas predominately utilize fixed bottom turbine foundations).